Nightmare On Wall Street:

This Secular Bear Has Only Just Begun

By Ed Easterling

July 1, 2012 (Updated)

Secular bull markets are great parties. Investors arrive from secular bears really wanting to take the edge off. As the bull proceeds, above-average returns become intoxicating. By the time it is over, the past decade or two has delivered bountiful returns. In contrast, secular bears seem like hangovers. They are awakenings that strip away the intoxication, leaving a sobering need for an understanding of what has happened. (Continue reading…)

http://www.crestmontresearch.com/docs/Stock-Nightmare.pdf

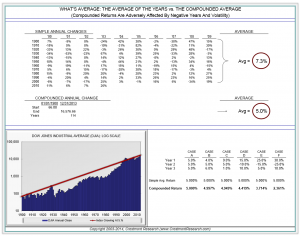

Investors only can spend compounded returns, not average returns. This chart presents the difference between average returns and compounded returns for investors. The two issues assessed are the impact of negative numbers and the impact of volatility, as measured by the variability within a sequence of returns. Both issues can devastate the actual returns realized by investors compared to the average. The first issue-negative numbers-is demonstrated by this example: an increase of +20% and a decrease of -20% may average zero, yet the net result is a loss regardless of the order in which they occur. The second dynamic-volatility-is illustrated by another example: the compounded return from three periods of 5% returns is greater than any other sequence that averages 5%.

http://www.crestmontresearch.com/docs/Stock-Average.pdf

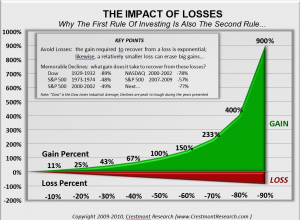

There is a very important reason that the ‘first rule of investing’ is also the second rule…it takes a lot of gain to make up for losses. This graphic highlights a key lesson of investing.

There is a very important reason that the ‘first rule of investing’ is also the second rule…it takes a lot of gain to make up for losses. This graphic highlights a key lesson of investing.

http://www.crestmontresearch.com/docs/Stock-Impact-Losses.pdf

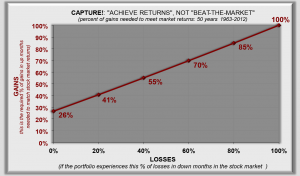

The simple analysis–graphed. Many “rowing” strategies are criticized for not achieving returns during market declines and then not being able to beat the stock market on the upside. The answer: if an investor can avoid the losses, it takes only a fraction of the positive gains to match (or beat!) the market. So the main objective of “rowing” is to avoid the losses…and the gains will seem to take care of themselves.

The simple analysis–graphed. Many “rowing” strategies are criticized for not achieving returns during market declines and then not being able to beat the stock market on the upside. The answer: if an investor can avoid the losses, it takes only a fraction of the positive gains to match (or beat!) the market. So the main objective of “rowing” is to avoid the losses…and the gains will seem to take care of themselves.

http://www.crestmontresearch.com/docs/Stock-Capture-Graph.pdf